If your company has an average net income after state and federal taxes of $5 million and your tangible net worth is less than $15 million, you have many options to consider when it comes to business loans, especially loans from the U.S. Small Business Administration (SBA).

The SBA is an excellent resource for information on loan programs exclusively for small and medium-sized businesses, also known as SMBs. Two of the most popular programs for SMBs are: SBA 504 and SBA 7(a). Both can help business owners maintain and grow their businesses. However, each have different purposes. Find out about them here!

504 loans

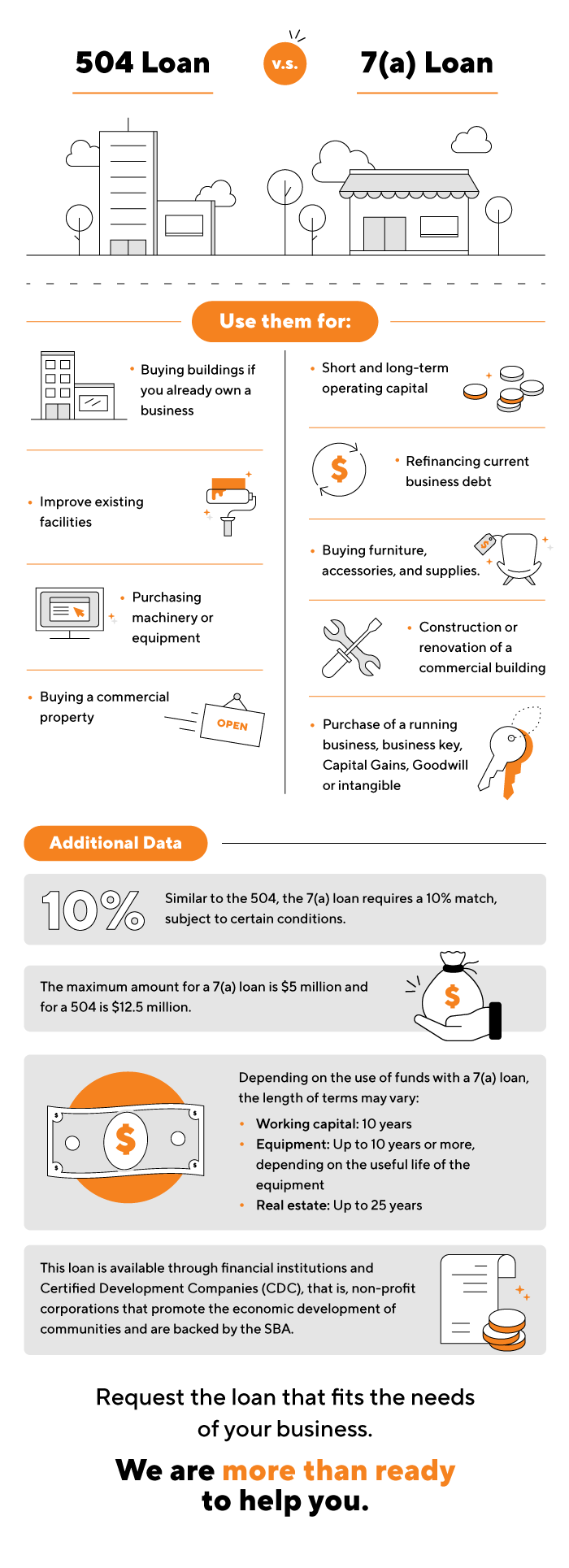

SBA 504 loans are intended to help business owners purchase buildings, improve existing facilities, purchase machinery and equipment, or purchase commercial property. In addition, they promote job growth in local communities.

7(a) loans

The 7(a) Loan Program is the best-known SBA loan program and includes financial aid for small businesses with special requirements. This is a good option if you plan to buy a commercial property.

These are the requirements to apply for the loan that best suits the needs of your business:

504 loans

- Operate as a for-profit business in the United States or its territories.

- Have a tangible net worth of less than $15 million.

- Have an average net income of less than $5 million after federal taxes for the two years prior to your application.

- If the purpose is to purchase commercial space, your business must occupy at least 51% of the building you are financing, create at least one job and meet the local CDC’s economic growth.

7(a) loans

- Be a for-profit organization

- Be considered a small or medium business, as defined by the SBA

- Engage in or propose to do business in the United States or its territories

- Demonstrate the need for a loan

- Use the funds for business purposes

- Not be in arrears on any existing debt with the government of the United States or its territories, including Puerto Rico.

Here we are sharing an infographic so that you can learn more about these loans:

Legal

Subject to credit approval by SBA. Certain terms and conditions apply.