Refinancing is an alternative to consider for the following purposes:

- Make property improvements or settle debts, if the property value exceeds the current mortgage balance. You can get money as a remaining in the refinancing transaction.

- Shorten the term of the loan

- Reduce the monthly payment on your current mortgage, when the interest rate on your existing mortgage is 2% or more than the interest rates of mortgage offer on the market. Here’s everything you need to know about refinancing your property.

Alternatives or types of refinancing

Reducing the term of the mortgage

Reducing the term of the mortgage means shortening the years of the loan you currently have. This can be achieved by making a new loan for a shorter term than the one you have left to pay.

The most important benefit is that it would reduce the time you have left to pay, so you would finish paying off your mortgage earlier, which would represent a saving in paid interests. For example, if you bought a property 6 years ago at an interest rate of 5.00% for 30 years, and you have 25 years left to pay. If the interest rates at the time of refinancing are at 3% or below, you can make a new loan for 20 or up to 15 years while maintaining a similar payment and saving between 5 and 10 years of interest. By saving you the interest of 5 or up to 10 years, you would not have to pay thousands of dollars.

Interest rates and the opportunity to reduce the monthly payment

People who have an interest rate on their current mortgage loan of 2% or more compared to the offered mortgages in the market, should evaluate the likelihood of refinancing to lower their monthly mortgage payment, without extending the time remaining of their current mortgage. Other debts could also be included in this type of transaction. This would be considered a refinancing with surplus, and it would be conditioned to the value of the property, according to the valuation, is greater than the current mortgage debt and the debts that you want to pay off. Keep in mind that refinancing also requires closing expenses.

What’s more convenient, to reduce the monthly mortgage payment or shorten the life of the mortgage?

The answer is very individual since it depends on each person’s financial situation, but here is an explanation of the advantages and disadvantages of each option.

Refinancing at 30 years is an option that offers you short-term savings. If you refinance your 30-year property with the lowest interest rates, you’re going to have a lower monthly payment than you currently have. By having a lower monthly payment, you will have money left to use for other financial commitments or save. However, if you had already been paying your mortgage for several years, you will again start to pay your mortgage for 30 years, but with a lower payment.

On the other hand, if you want to refinance your 15-year mortgage, the advantage will be long-term, since you will save paying interest for an additional 15 years. The disadvantage of this option is that in most cases, you will have a monthly payment on your mortgage equal to or greater than the one you currently have. The savings in this option are long-term, as it will be for unpaid interest.

However, to qualify for a 15-year mortgage can be more difficult than qualifying for a 30-year mortgage. Since on a 15-year mortgage, the monthly payment is higher, the applicant’s income should be higher, and the percent qualification will be stricter. This does not mean that it is tough to qualify. Still, it is an evaluation that must be made on a case-by-case basis, according to each person’s financial circumstances.

How do I request a refinance?

To apply for a mortgage loan with Oriental, you have several alternatives.

- Access our website or contact 787.777.2272.

- Visit one of our branches conveniently located throughout the island.

- Additionally, you can make an appointment and one of our executives can visit you at your home or workplace. The mortgage officer in charge of your case will explain the entire procedure, from the application to the closing of your mortgage loan.

To request a refinancing of your mortgage, you need to indicate the transaction’s purpose (lower monthly payment, lower years, get a surplus, consolidate debt). You must be able to provide information related to your property, i.e., monthly payments, interest rate, estimated value of the same and current debt. If you want to consolidate debts, you must be able to provide the bank with their totals and if you want a surplus, you must be able to indicate the amount and its purpose.

Necessary documents

The initial documents that you must provide to the bank at the time of filing for a mortgage loan are:

- Deeds Property (Registry Data)

- Cadastre Number (CRIM)

- Evidence of Income (W2/Payroll/etc.)

- IDs

- Among other documents

What are the expenses and obligations you should consider when applying for a mortgage loan?

To evaluate your expenses and obligations for them to be considered during the process of qualifying your mortgage, you must identify all those obligations in which you have to make a timely or periodic payment. We often forget that there are automatically made payments, that perhaps you could have had overlooked. You should also remember that all those obligations you appear as a debtor or co-debtor, can be considered an expense during the qualification process. In the same way, when you are reporting income, you must ensure that you can show documentary evidence of it and the potential permanence of this income. This means that it is not an eventual income, that it is not a non-recurring income every month.

We encourage you to recollect all your expenses before you begin the refinancing process, and periodically review your credit report to ensure that it reflects the reality of your obligations.

To calculate the monthly payment of your mortgage, access our website.

Factors taken into consideration to approve a refinancing

- Credit score: For any financial and mortgage transaction, the credit score is key to achieving the desired approval and the best conditions in the closing offer. The credit history shows your debts and how you paid them off. Healthy credit can make it easier to approve your loan and have a better interest rate. The score fluctuates between 350 and 850, depending on the company. In the United States, the average is at 700; however, if your score is above 680, it is considered good and any score above 750 is excellent. Having a limited or imperfect credit history doesn’t mean you won’t qualify to refinance your mortgage. If, for example, your credit has been affected by situations such as divorce or illness, you must present the necessary evidence to facilitate the analysis of your case.

- Employment and income: Among the determining factors when applying for a refinancing of your mortgage are employment and income verification. You must demonstrate the “repayment ability” of mortgage debt, so it is of the utmost importance to be able to solidly verify your employment and income.

First, verification of employment is done. How long have you’ve been employed, your salaries and other income such as bonuses, commissions, incentives, etc., probability of continuing in employment and other conditions related to you and your employer. It is important that you have been employed at the same workplace for at least two years or more. If you own your own business, the certified accountant who prepares your financial statements and manages the financial part of your organization, must certify your employment and income together with statements and evidence of the company from which they are received. - Money for closure: The down payment required will be according to the type of financing and loan you choose and/or qualify for. There are mortgage insurances and aids that allow a lower down payment. To this down payment, the closing costs are added. This amount is verified with the bank or can be deposited into a reserve account. It can also be donated by a family member. However, you should not take out a loan to cover this expense.

- Property appraisal: The property will be the collateral of the requested loan, so an appraisal must be made to indicate its value. To establish the maximum loan, the sale price or the appraised value, whichever is lowest, is always used as a basis. Valuation is prepared using recent sales in similar areas and to compare them to the property in question. In addition to using the comparable sales method, it uses the rental market and cost of reproduction of the property being appraised. Typically, the method with the most weight in the final analysis, is comparable sales. In addition to establishing the property’s value, the appraisal tells us if it is in a flood zone and needs repairs to put it in optimal condition.

What happens after you apply for a loan?

- After completing your application, all information you have provided will be processed and validated.

- The legal and contributory status of the property is verified. The bank’s responsibility is to verify that the property is free of encumbrances.

- The legal part is verified through the studies of title and deeds, property measurement, and debt and values certifications.

- The required documents of the client are verified to evaluate their eligibility.

Once the loan is approved, a closing officer will reach out to you to provide the final information and coordinate a closing date.

If your application is not approved, you will receive a letter from the bank stating the reasons why it was denied. We recommend that you contact your bank official to let you know the reasons. Also, ask what steps you need to take in the future to qualify for a refinance.

5 stages of the refinancing of your mortgage loan

Once you begin the process of refinancing your mortgage loan, you will no longer have to visit the branch to know the status, deliver or sign documents. For your convenience, everything will be worked through our digital platform. We are more than ready to help you in the process with care, speed, clarity, and options to choose from.

- Loan application: To refinance your property, we are here to help you. Get started with a click here to apply. It’s quick and easy.

- Orientation: We evaluate your situation and advise you on the best product that suits your needs.

- Analysis of your request: As part of the analysis and product requirements, we may ask you for additional or updated information.

- Credit decision: We evaluate the information received from your credit, income, and property history. The decision on your loan could be approval, conditional approval, counteroffer, or denial.

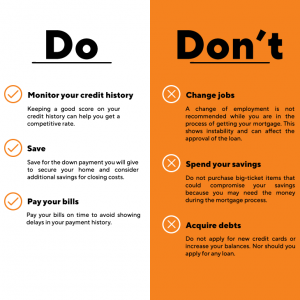

Do’s and don’ts if you’re buying your home

Disclosures

Subject to credit approval. Certain terms, conditions, and restrictions apply. Equal Housing Lender.